capital

raising

screening of investment opportunities

acquisition & development of properties

property

management

property

selling

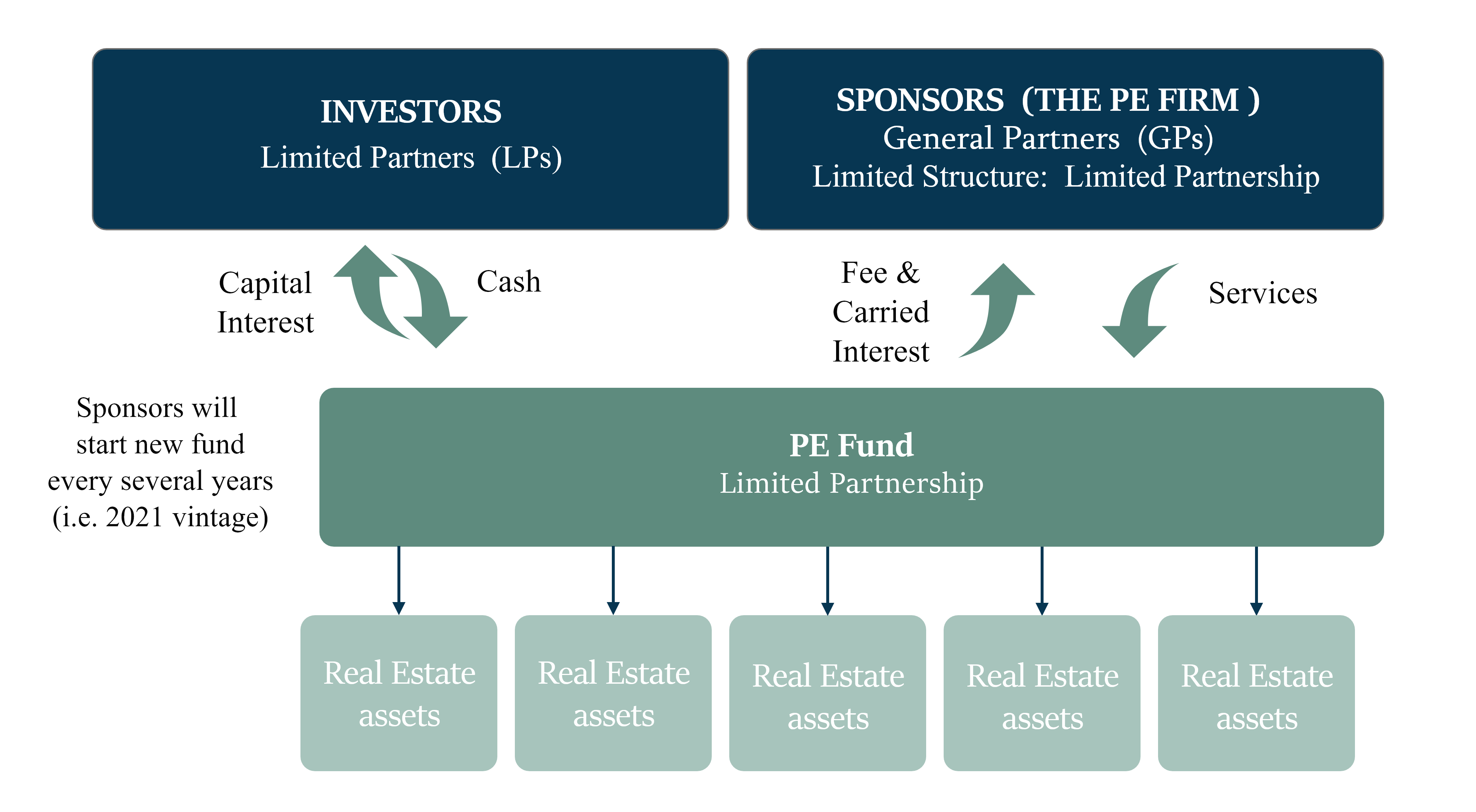

The capital raised by our firm comes from Limited

Partners (LPs). Our LPs

generally consist of

public pension funds, private pension funds, endowments, insurance companies, fund of funds, and

high net worth individuals.

We raise capital for our specific individual investment vehicles that run by our company. These

funds are designed to have their own “mandates” meaning they have specific types of real estate

investments that we target.

All our Funds are “closed-end funds” meaning that investors expect to get their money back

(ideally along with a hefty return on investment) within a specified time frame – usually within

3-5 years.

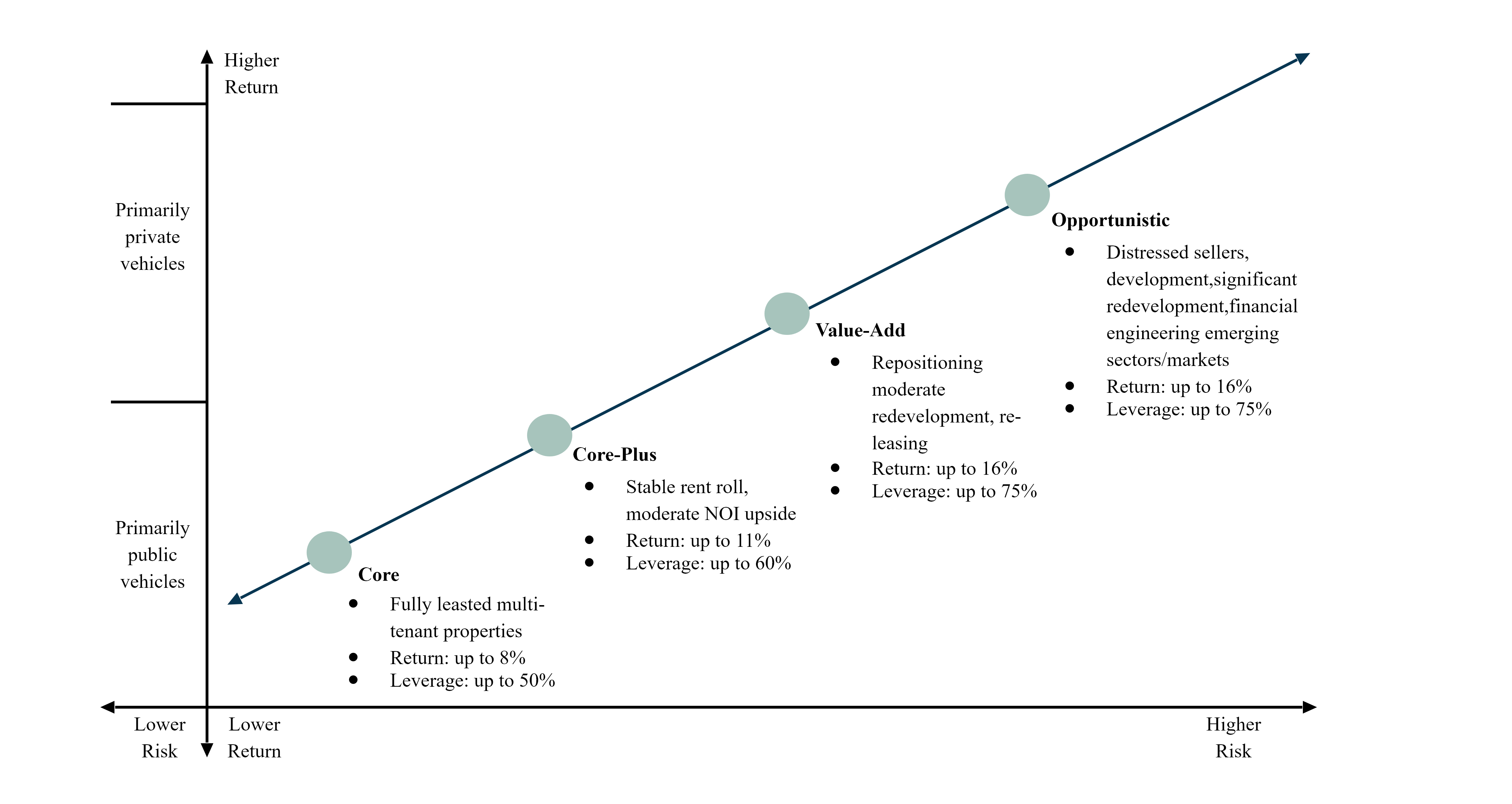

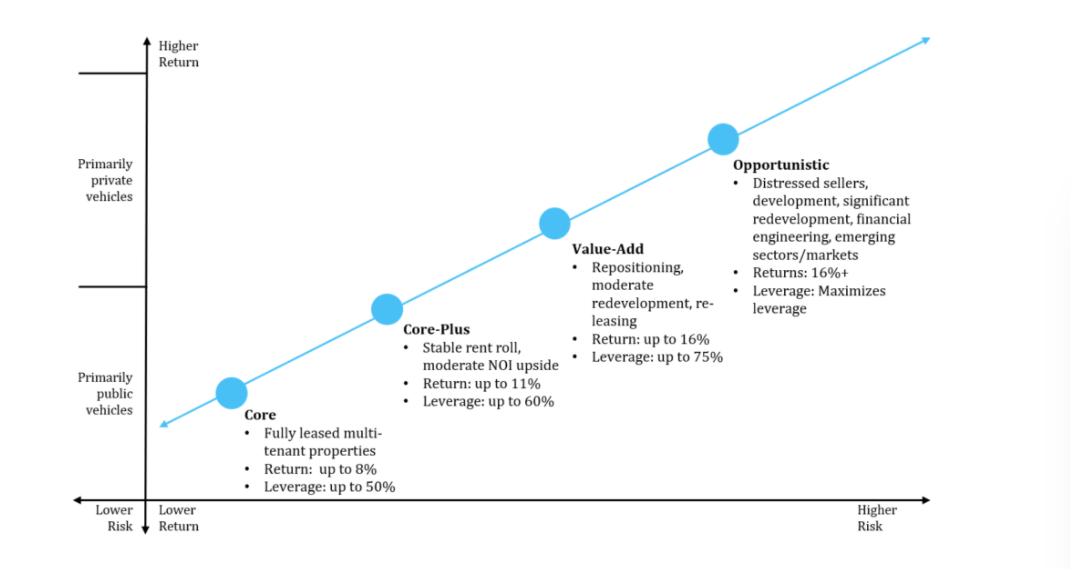

Khoie Family Office (KFO) is organized according to risk profile as our driving investment strategy. We carve out a portion of the risk/return spectrum and focus on transactions – regardless of property type and geography – that fit the specified risk profile and return targets.

At KFO, we strive to balance the types of real estate private equity fund strategies between “Opportunistic” or “Value-Add”, and conservative “Core” or “Core-Plus” strategies. In the image below you can see the return profile targeted across these different strategies.

This is an effective way that we have organized ourselves because it sets clear expectations for our investors and allows us to diversify risk across geography and property type.

At KFO, we do not constrain ourselves when it comes to property type. We would focus exclusively on one property type, hotels for example, and then diversify our investments in other ways within the property type sector.

Residential like the office buildings include everything from skyscrapers to small apartments or single family homes.

Residential and Office buildings include everything from skyscrapers to small single tenant office buildings.

Rents and valuations are influenced by employment growth and a region’s economic focus.

Due to the length of office leases and the sector’s correlation to the economy, a tenant’s credit quality is very important.

The retail sector comprises properties that house retailers and restaurants.

Our target properties can be multi tenanted with an anchor tenant to drive traffic or single use, standalone buildings.

The retail sector is the most diverse asset class with subcategories ranging from shopping malls to standalone restaurants.

With the rise of e-commerce, the retail sector has become the least favored real estate asset class.

The industrial sector houses operations for the storage and/or distribution of materials, goods, and merchandise. Typically single story and located outside urban areas along major transportation routes.

Our industrial properties tend to have less than 15% office space, and modern facilities have high ceiling clear heights that allow for more storage space. Buildings may also include specialty features, such as cold or freezer storage for food.

Industrial properties are the least operationally intensive asset class given their ease of construction, simple design, and lack of focus on aesthetics.

With the rise of e-commerce, the industrial sector has become the most favored real estate asset class.

Hospitality real estate encompasses properties providing accommodations, meals, and other services for travelers and tourists.

The hospitality sector primarily comprises hotels but also includes casinos and resorts.

Relative to other asset classes, hospitality is the most operationally intensive because of the number of employees involved and the range of amenities such as full service restaurants, room service, valet parking, and event space.

Because it caters to travelers and tourists, the hospitality is highly correlated with the broader economy and is therefore viewed as the most risky of the asset classes.

Our geographic focus is the East Coast of the United States, the Continental Europe and some selective targets like Dubai Marina and Singapore. We work hard on our strategic perspective such as developing a higher level of expertise in an area and gaining a deeper network. From an operational perspective, we remain technology intensive to requires fewer offices across the world and reduce the amount of time our employees must spend traveling to visit properties.

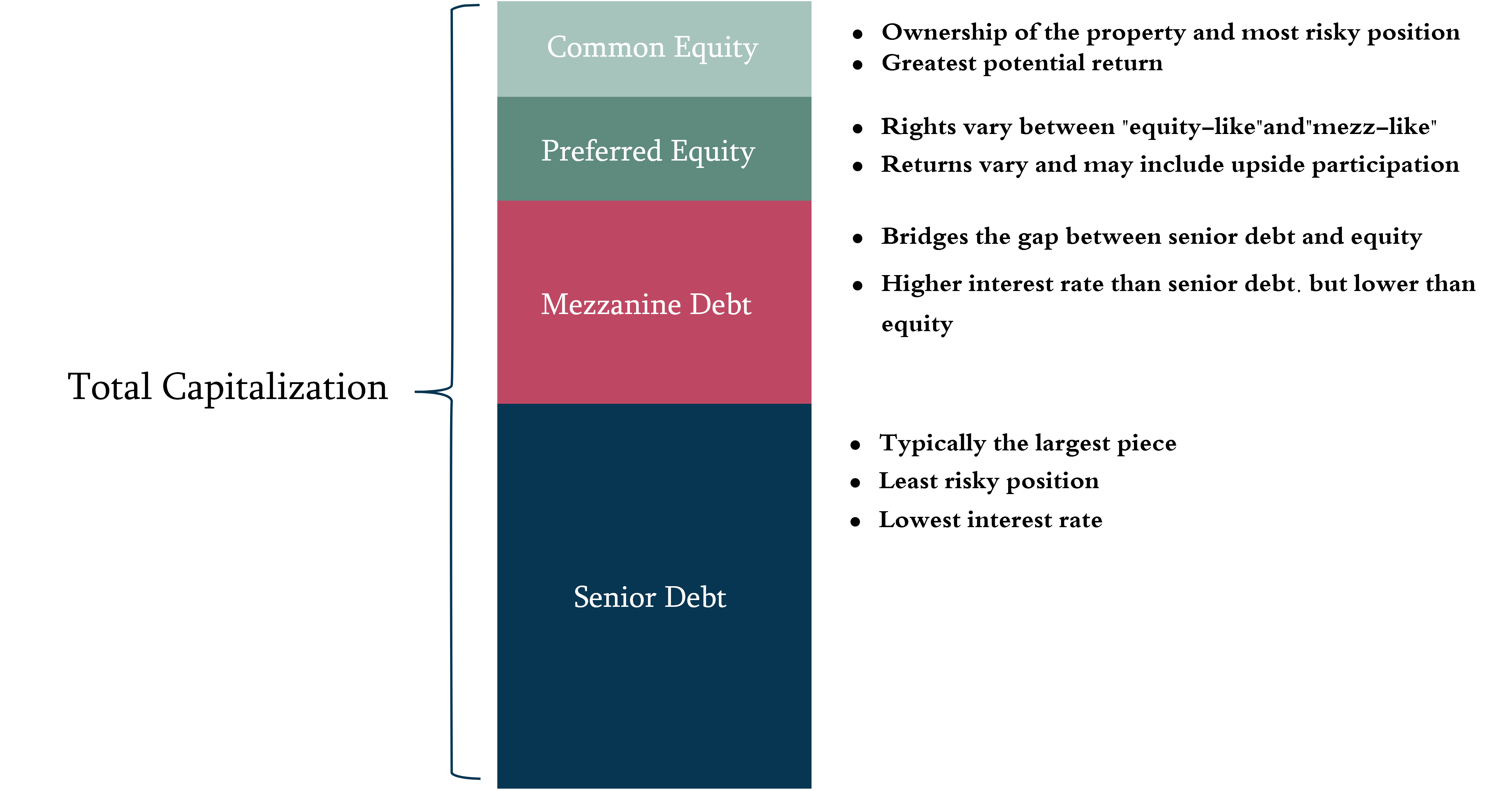

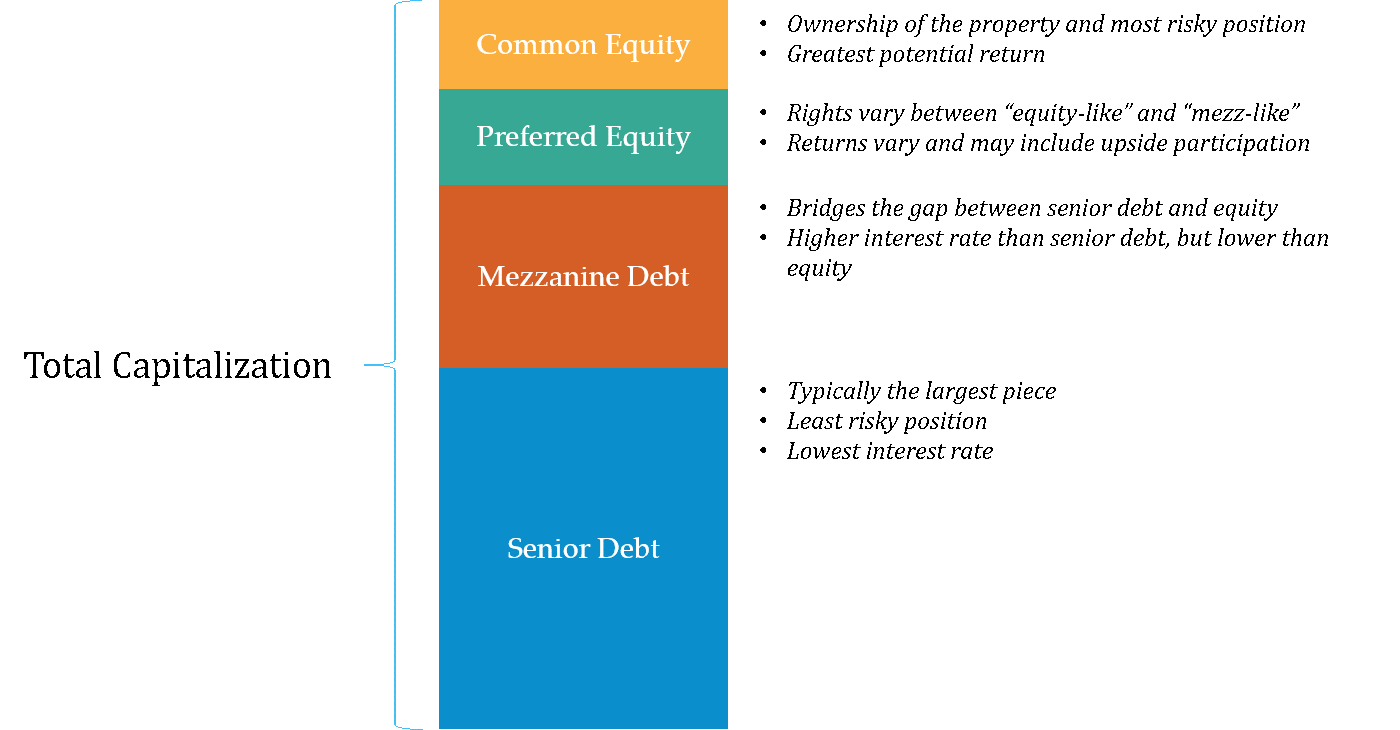

Traditionally, REPE firms focus on equity investment, but at KFO we believe that REPE can also pursue debt- investment strategies where we make investments in different parts of the Capital-Structure. Thus, we invest in both equity and debt.

Khoie Family Office (KFO) is organized according to risk profile as our driving investment strategy. We carve out a portion of the risk/return spectrum and focus on transactions – regardless of property type and geography – that fit the specified risk profile and return targets.

At KFO, we strive to balance the types of real estate private equity fund strategies between “Opportunistic” or “Value-Add”, and conservative “Core” or “Core-Plus” strategies. In the image below you can see the return profile targeted across these different strategies.

This is an effective way that we have organized ourselves because it sets clear expectations for our investors and allows us to diversify risk across geography and property type.

At KFO, we do not constrain ourselves when it comes to property type. We would focus exclusively on one property type, hotels for example, and then diversify our investments in other ways within the property type sector.

Residential like the office buildings include everything from skyscrapers to small apartments or single family homes.

Residential and Office buildings include everything from skyscrapers to small single tenant office buildings.

Rents and valuations are influenced by employment growth and a region’s economic focus.

Due to the length of office leases and the sector’s correlation to the economy, a tenant’s credit quality is very important.

The retail sector comprises properties that house retailers and restaurants.

Our target properties can be multi tenanted with an anchor tenant to drive traffic or single use, standalone buildings.

The retail sector is the most diverse asset class with subcategories ranging from shopping malls to standalone restaurants.

With the rise of e-commerce, the retail sector has become the least favored real estate asset class.

The industrial sector houses operations for the storage and/or distribution of materials, goods, and merchandise. Typically single story and located outside urban areas along major transportation routes.

Our industrial properties tend to have less than 15% office space, and modern facilities have high ceiling clear heights that allow for more storage space. Buildings may also include specialty features, such as cold or freezer storage for food.

Industrial properties are the least operationally intensive asset class given their ease of construction, simple design, and lack of focus on aesthetics.

With the rise of e-commerce, the industrial sector has become the most favored real estate asset class.

Hospitality real estate encompasses properties providing accommodations, meals, and other services for travelers and tourists.

The hospitality sector primarily comprises hotels but also includes casinos and resorts.

Relative to other asset classes, hospitality is the most operationally intensive because of the number of employees involved and the range of amenities such as full service restaurants, room service, valet parking, and event space.

Because it caters to travelers and tourists, the hospitality is highly correlated with the broader economy and is therefore viewed as the most risky of the asset classes.

Our geographic focus is the East Coast of the United States, the Continental Europe and some selective targets like Dubai Marina and Singapore. We work hard on our strategic perspective such as developing a higher level of expertise in an area and gaining a deeper network. From an operational perspective, we remain technology intensive to requires fewer offices across the world and reduce the amount of time our employees must spend traveling to visit properties.

Traditionally, REPE firms focus on equity investment, but at KFO we believe that REPE can also pursue debt- investment strategies where we make investments in different parts of the Capital-Structure. Thus, we invest in both equity and debt.